There is a common myth that "sustainability" and "capitalism" are contradictory. That is, radical people tend to think either (1) global capitalism (i.e., business trends that focus heavily on innovation and efficiency) always sacrifices something important, or (2) living sustainably is unrealistic and meaningless given the modern lifestyle we've already adapted. Hence, it's easy for us to conclude that the both concepts won't be mutually achievable.

However, I personally believe it's not always true for the following reasons:

- Many of the critical social/environmental problems were originally caused by technological innovations in human history (e.g., transportation, communication, mechanization), and hence making yet-another innovation driven by capital is the only effective way to truly overcome the situation. I have been a strong believer of technology for many years, and the mindset was even strengthened by Bill Gates's climate book.

- As I learned in Environmental Problems Through the Lens of Business, it's certainly possible to view sustainability-related challenges as a business problem. Currently, such efforts are rarely made by limited start-up companies, but what if more investments are made in the market, and the number of players increases accordingly?

Here, I recently encountered a new concept of sustainable capitalism and had an opportunity to learn about it to deepen my thoughts further.

Definition

In the sustainable-capitalism world, more sustainable businesses become more profitable, and it minimizes the negative social and environmental impacts without stopping the progress.

Although we can find many online articles describing about the co-existence of sustainability and capitalism, Generation Investment Management, an investment firm co-founded by former US Vice President Al Gore and Goldman Sachs' banker David Blood, seems to be the biggest contributor who is widely advancing the concept of sustainable capitalism1. It should be noted that their direction has recently been recognized as "the next big thing in investing" by the entrepreneur communities.

According to an informative interview, they explain the new wave as follows:

The idea [of sustainable capitalism] is that if some tenets of "long term" and "value based" investing are extended to include the environmental and social ramifications of corporate activity, the result can be better financial performance, rather than returns that are "nearly as good" or "worth it when you think of the social benefits."

Al Gore’s Green-Technology Investment Strategy and the Fight Against Climate Change - The Atlantic

It is true that capitalism is harmful to the society and environment, as long as the market only has a short-term outlook; rapid market growth widens the gap between rich and poor, and such short-term profitability pressures force organizations to ignore negative externalities. On the other hand, Generation's investing strategy is a system that fights against short-term views, incentivizes positive externalities, and encourages the market to have a long-term way of thinking.

Why sustainable capitalism matters

For me, the importance of sustainable capitalism can be two-fold:

- Decrease a chance of falling into short-term mitigation that doesn't scale

- Increase the long-term adaptability towards the unforeseen future

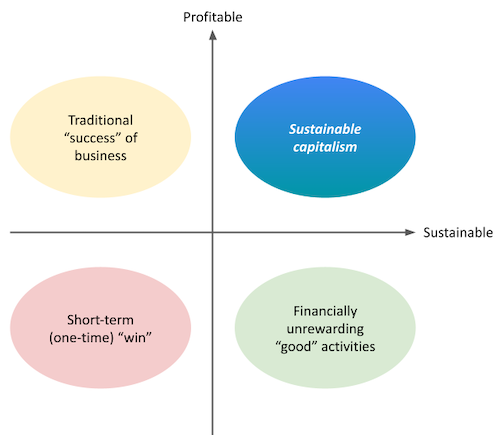

To begin with, what are the non-sustainable-capitalism approaches? We can classify many different organizational and individual activities based on how they balance profitability and sustainability:

- "Profitability matters": It's a traditional way of business execution. Your goal is to be profitable in the shortest path e.g., IPO.

- "Sustainability matters": Non-profit, volunteer, and radical actions that resist the global capitalism—All of them are wonderful behaviors, but it unfortunately won't scale enough; it is difficult to attract more people and make a bigger impact to achieve truly important goals.

- Neither profitable nor sustainable: Even if you are ambitious enough, it's very possible that your actions ended up with failure of fundraising and/or short-term mitigation that doesn't contribute to sustainability as much as originally hoped.

In contrast to three of them, sustainable capitalism allows us to optimize both parameters at once and maximize positive externalities (minimize negative externalities) while ensuring financial stability in the long-run.

Most importantly, as we learn from our day-to-day job, providing a stopgap solution to mitigate an immediate risk could be even harmful in practice. We rather need to provide a systematic solution that resolves a fundamental problem and ensures the same problem never happens again. A key element here is having enough capacity in terms of both time and money to dive deep into the important problems, and hence sustainable capitalism unlocks new opportunities for innovators to polish their ideas; they don't necessarily have to rush anymore for accumulating quick wins given a short period of time.

Additionally, spending enough time and money on innovations in a long-term perspective (1) gives a better understanding of the problems we're facing and (2) increases versatility of final outcomes. It is important to realize that nobody knows what will happen in the future, and a long-term outlook must take into account the uncertainty as well as the best "guess" at this point of time. That's one reason why short-term mitigation is likely to fail. Long-running sustainable-capitalism approaches, on the other hand, can be incrementally optimized against a certain objective in a timely manner.

How we can adapt to the sustainable-capitalism mindset

In the article I referred above, Generation Investment Management demonstrated their measurements to assess how promising a company is in terms of both profitability and sustainability. Similarly, we can define own criteria to improve our day-to-day decisions, and I believe it's one of the most important steps to be a part of the sustainable-capitalism initiative.

There are many decision-making points in our life at different scales:

- Glossary purchase

- Dining

- Entertainment

- Transportation

- Housing

- Career

- ...

In my case, for example, I regularly educate myself on the relevant topics2 so I keep contributing to social good when I eat, drink, create, and move. Meanwhile, I chose Amazon as a recent career decision, and one of the primary reasons is to be a part of their long-term sustainable commitment as I described in the article.

Speaking of big companies and sustainable capitalism, it should be noticed that Generation makes an investment regardless of corporate size as long as they meet the evaluation criteria. To give an example, they do invest in Microsoft.

Every company on the focus list—big or small, household name or obscure start-up—had passed Generation’s internal test of offering good long-term business prospects. The big, familiar names were in one way or another advancing a sustainability goal.

Al Gore’s Green-Technology Investment Strategy and the Fight Against Climate Change - The Atlantic

We are living in an extremely short period of time compared to the millions of years of Earth's history, and no one is capable to define what "sustainable" means for the entire ecosystem in a true sense. For instance, we might face a new "Global Cooling" issue a couple hundred years later, which requires completely opposite efforts to prevent the nature—But who knows? Therefore, having a long-term viewpoint with a strong financial backup is one of the most promising ways of ensuring an eventual positive consequence.

1. Sources: "Sustainable capitalism - Wikipedia", "How To Achieve Sustainable Capitalism - Forbes" ↩

2. For example: "A Journey of Sustainable Development", "Unusual Drinking & Eating Habits: Non-Alcohol, Decaf, Flexitarian", "Reviewing Ethical Challenges in Recommender Systems" ↩This article is part of the series: Ethical Product Developer

Support

Gift a cup of coffeeShare

Categories

See also

- 2021-09-24

- Understanding Big Tech's Sustainable Commitment with Word Cloud

- 2021-08-28

- Next "Dot" in Journey: Curiosity-Driven Job Change in Canada (Aug 2021)

- 2021-04-30

- Environmental Problems Through the Lens of Business

Last updated: 2022-09-02

Author: Takuya Kitazawa

I am an independent consultant, mentor, and advocate for sustainable technology development with a decade of experience in AI/ML products, data systems, and digital transformation. Based in Canada and originally from Japan, I have lived and worked globally, including part-time residence in Malawi, Africa. See CV for more information, or contact at [email protected].

NowDisclaimer

- Opinions are my own and do not represent the views of organizations I am/was belonging to.

- I am doing my best to ensure the accuracy and fair use of the information. However, there might be some errors, outdated information, or biased subjective statements because the main purpose of this blog is to jot down my personal thoughts as soon as possible before conducting an extensive investigation. Visitors understand the limitations and rely on any information at their own risk.

- That said, if there is any issue with the content, please contact me so I can take the necessary action.